The actual SST charges depend on the type of goods rendered. Sales tax administered in our country is a single-stage tax charged and levied on locally manufactured taxable goods at the manufacturers level and as such is often referred to as manufacturers tax.

International Shipping To Malaysia A Guide For Ecommerce Merchants Janio

Procedures for Postal Parcels.

. Genting Berhad Searching Chinese phrase. In Malaysia the import duty rates can range from as low as 0 to as much as 50. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018.

MOTAC - MINISTRY OF TOURISM AND CULTURE MALAYSIA. Every country is different and to ship to Malaysia you need to be aware of the following. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email.

Youll be charged Customs Duty on all goods sent from outside the UK or the UK and the EU if youre in Northern Ireland if theyre either. However the government has recently announced that this will be raised to 9 by 2025. PREPARED BY ROYAL MALAYSIAN CUSTOMS DEPARTMENT.

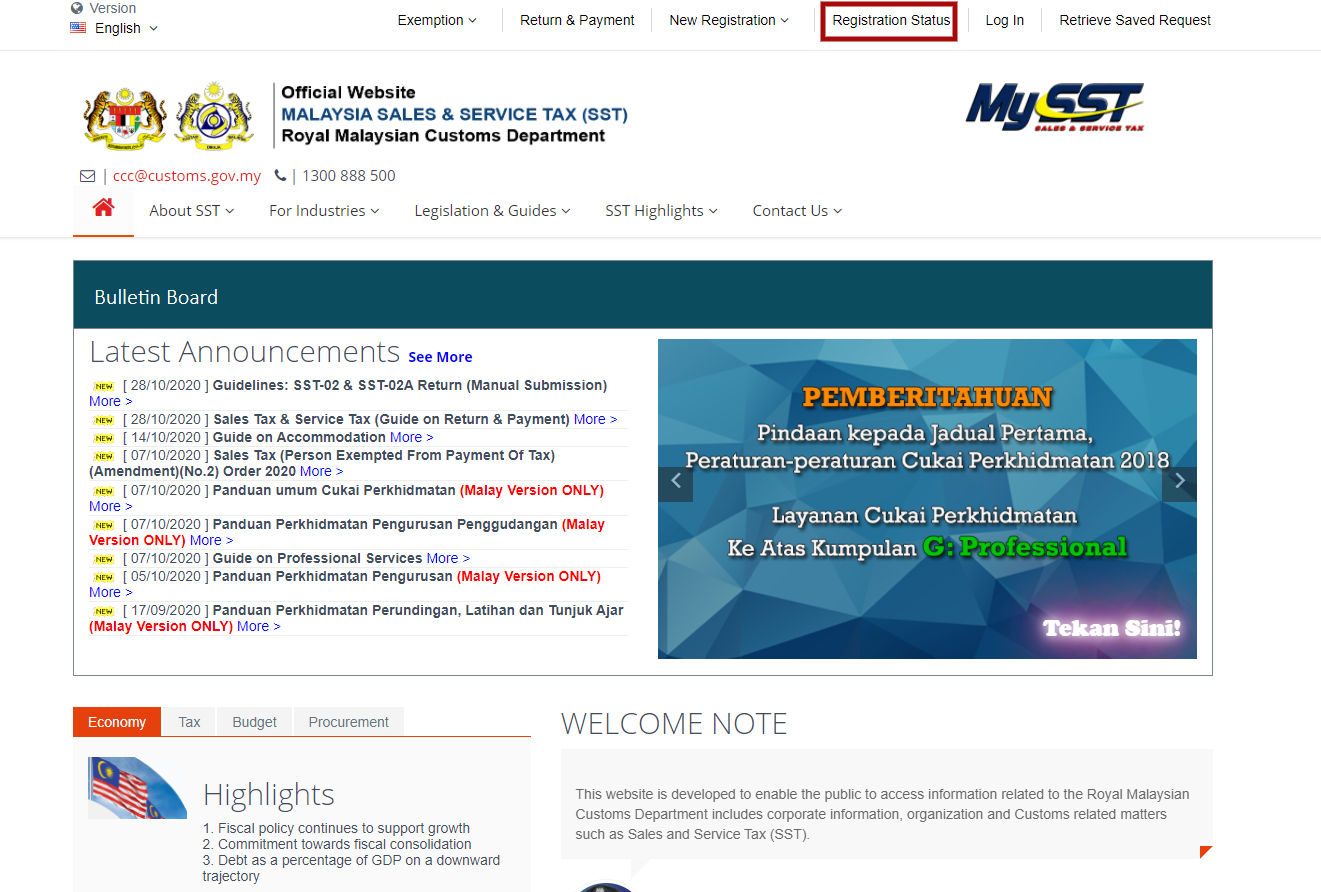

RMCD - ROYAL MALAYSIAN CUSTOMS DEPARTMENT. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. Trying to get tariff data.

For further enquiries please contact Customs Call Center. Worth more than 135. Food preparations up to RM75 in value.

Import and export of illicit drugs eg. In many cases the average duty rate is around 6. Over a dozen people that Malay Mail spoke to said they felt the RM50 minimum charge to process the Customs forms was too.

The average Malaysian has good spending power with Malaysias GDP per capita being the third-highest among ASEAN nations 2. Things To Know When Shipping To Malaysia. 1MDB MAS Searching all words.

If you choose Delivery Duty Unpaid DDU there. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the Ministry of Health Malaysia. Singapore customs tax and duties.

This Guide merely serves as information. KUALA LUMPUR Foreign digital service providers will soon be taxed for their services in Malaysia as authorities look to amend several tax laws. GST was only introduced in April 2015.

Ccccustomsgovmy For classification purposes please refer to Technical Services Department. THE PUNISHMENT FOR DRUG TRAFFICKING IS DEATH BY HANGING. Importing by Postal or Courier Service.

You have to pay the import duty imposed by the Customs. Some goods are exempt from duties such as electronic products like laptops and electric guitars. Cross-border sales fulfil many Malaysians love for.

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Steps to disable browser pop-up blocker. Though not strictly an import tax all goods entering Singapore are subject to a 7 Goods and Service Tax GST.

MOF - MINISTRY OF FINANCE. Malaysias E-commerce industry is expected to grow at an annual growth rate of 114 percent CAGR 2019 -2019 and the total revenue for the entire industry is 131 billion. NEW GUIDE ON TOURISM TAX DPSP 18082021 MyTTx Online Services.

However the amount of duty rates charged in advance by different movers vary. UPDATED 638PM Sales tax on foreign goods sold by online traders. High speed rail author Bhattacharjee category From the Edge Searching either words.

ECommerce Domestic Market. Malaysias Customs Department director-general T. Morphine heroine candu marijuana etc are strictly prohibited.

Whether or not your shipment will be taxed is somewhat of a gray area in Malaysia Buyandship suggests our members to be aware of the general rule of thumb for import tax and duty. There is currently an SG400 duty-fee threshold for applying GST which means imported goods whose total value is less than. With more than 20 active bilateral and regional Free Trade Agreements FTAs the garden city has a relatively open-trade policyTherefore the barrier of entry is rather low.

However for Malaysian retailers looking to import goods or services to the domestic market it is essential to take note of the customs tariffs payable. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. Click on the links below for information on duties Goods and Services Tax GST and clearance procedures for items bought online.

In general the import tax rate in Malaysia starts from 0 5 to 10 of the shipment value but may be subjected to change depending on products. 1 new pair of footwear. Known as one of the Tiger Cub 1 economies Malaysias developed infrastructure and strong economy make it a popular expansion option for eCommerce merchants.

Sales tax to be imposed on low-value items sourced overseas sold by online. The tax is also imposed on taxable goods imported into the Federation Sales tax. Tax usually occurs when the CIF value of shipment is more than RM 500.

All other goods except alcohol tobacco tyres and tubes up to RM400 in value RM500 if they are goods from Labuan Langkawi or Tioman If youre not bringing in any items exceeding the above limits you dont have. But in Malaysia at least some online shoppers have started to ditch DHL following claims that the courier charges excessive fees to process Customs duties or tax papers for items imported through its services. The Sales Tax Act 1972 came into force on 29 February 1972.

Goods and Service Tax. Please refer to Sales. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline.

Buying over the Internet. SST is administered by the Royal Malaysian Customs Department RMCD. 1 portable electric appliance for personal care and hygiene.

When youre shopping online overseas one of the top concerns is getting taxed by Jabatan Kastam Diraja Malaysia.

Lcd Bluetooth Headphones With Mic Fm Radio Tf Card Slot 6 Colors Wild Wireless World In 2022 Bluetooth Headphones Wireless Headphones Headphones With Microphone

Malaysia Sst Sales And Service Tax A Complete Guide

How To Avoid From Custom Duties In Malaysia Xtremepassion

Buy Zalora Now Online Zalora Malaysia Brunei

Malaysia Sales Tax On Low Value B2c Imported Goods 2023 Service Tax On Delivery Services 2022 Vatcalc Com

Starting 2023 Imported Goods Below Rm500 Purchased Online Will Be Taxed In Malaysia Technave

I Am A Tax Accountant Sometimes I Need Expert Advice T Shirt Hoodie T Shirts Hoodies Shopping Now Tax Accountant Shirt T Shirt Hoodie Shirt Shirts

Online Shopping Tax Malaysia Is A Step Closer To Impose 10 Tax On Imported Goods Worth Under Rm500 Soyacincau

New Taxes On Small Online Purchases Delivery In Malaysia Tech Arp

All You Need To Know About Malaysia S Import Taxes Dhl My

Malaysia Sst Sales And Service Tax A Complete Guide

International Shipping To Malaysia A Guide For Ecommerce Merchants Janio

Women S Maroon Banarasi Silk Weaving Jacquard Saree Gnp0107586 Soft Silk Sarees Indian Designer Sarees Silk

Malaysia Sst Sales And Service Tax A Complete Guide

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Chicago Limo Service Limo Company

Shipping To Malaysia Services Costs And Customs